SEI, the native token of the Sei Network, has emerged as one of the top-performing crypto assets in June. The open-source, Cosmos-based Layer-1 blockchain is up by over 100% month-to-date.

This surge comes despite a broader lull among altcoins, with the SEI token presenting as an outlier this month.

SEI Price Doubles in June: What Users Need To Know

The Sei token price surged by nearly 10% in the last 24 hours alone, according to data on BeInCrypto, and over 90% in the past week. Over the last month, the token is up by over 100%. As of this writing, SEI was trading for $0.30425.

The move was catalyzed by a flurry of bullish developments, most notably, SEI’s selection for a US government-backed stablecoin pilot, growing institutional attention from Circle and ETF (exchange-traded fund) prospects, and surging ecosystem adoption.

Wyoming Stablecoin Pilot Selection Boosts Credibility

The clearest trigger for SEI’s explosive breakout was the state of Wyoming’s official selection of the SEI Network for a blockchain-based stablecoin pilot. As part of the initiative, Sei ranked ahead of more established networks like Ethereum, Avalanche, Sui, and Ripple.

The announcement elevated SEI’s reputation, signaling strong public-sector confidence in its technical capabilities and regulatory posture. This high-profile endorsement ignited community and investor optimism, especially as more US states begin exploring digital dollar infrastructure.

Institutional Fuel: Circle Holdings and SEI ETF Filing

SEI’s institutional narrative has also gained significant momentum. USDC stablecoin issuer Circle revealed in its IPO filings that SEI is the largest crypto token on its balance sheet, surpassing Ethereum and Bitcoin holdings.

This revelation redefined investor perception around SEI’s strategic importance and long-term potential.

Adding to the momentum, asset manager Canary Capital filed for an ETF based on SEI. If approved, the fund would mark a historic step in expanding institutional access to the SEI ecosystem.

“Exciting to see major progress in the institutional adoption of Sei,” Sei co-founder Jeff Feng commented in a post.

This ETF narrative and Circle’s backing have fueled expectations of more structured capital inflows and reduced volatility. Notably, these are key criteria for risk-averse institutional investors.

Ecosystem Growth and Whale Inflows Support Price Action

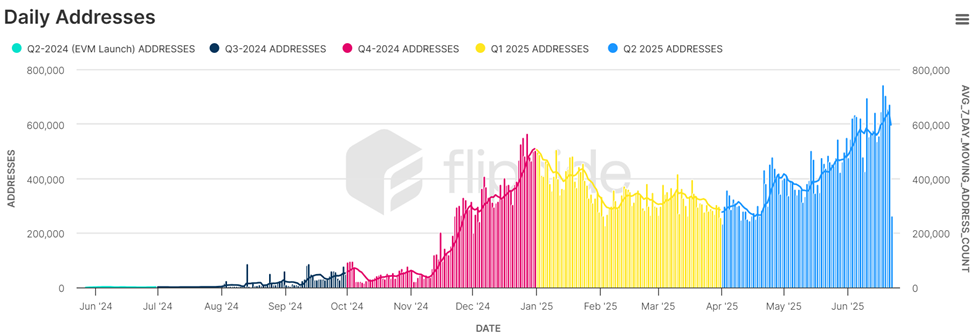

Beyond headlines, real adoption metrics underpin SEI’s bullish momentum. BeInCrypto reported the network recently hitting 600,000 active wallets, even as the token corrected 30% earlier in the month.

Sei recently claims the second position among all EVM-compatible chains by user count, ahead of Arbitrum, Optimism, Polygon, and BNB Chain.

Sei community member Philip further emphasized Sei’s expanding dominance, owning nearly 30% market share of the entire Web3 gaming market. It surpasses networks like Ronin and BNB in user traction.

The total value locked (TVL) on Sei has also risen sharply, now at an all-time high and halfway to the $1 billion mark.

According to DefiLlama data, Sei has a TVL of $560.28 million as of this writing, with new DeFi protocols Takara Lend and Yaka Finance among those driving growth.

World Liberty Financial Buys $1 Million Worth of SEI

Adding to the buying pressure, blockchain sleuth Lookonchain reported that Trump-affiliated World Liberty Financial bought nearly 6 million SEI tokens for $1 million, now worth $1.8 million.

With this, the Trump family’s DeFi venture netted an 80% unrealized profit.

The trade appears to have amplified traders’ fear-of-missing-out (FOMO), with CoinGecko data showing daily trading volumes topping $1 billion.

With converging on-chain metrics, institutional alignment, and government partnerships, SEI’s parabolic June performance may begin a longer-term trend.

However, this depends on maintaining network momentum and fending off rivals in the fast-paced Layer-1 (L1) race.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment